Articles

You may be thinking counterintuitive https://happy-gambler.com/cutesy-pie/ since the banks are accustomed to shop currency; although not, this opens of many potential. Almost any the things about beginning a merchant account instead in initial deposit, we will crack they down, so you know all of the choices. Although not, because of immediate cash crunch, there might be times when you may have to too soon withdraw from your repaired put membership, which will focus a penalty. And this, to avoid one to, there are particular means by which you could potentially avoid penalty to possess untimely withdrawal out of FD. Depending on the Set-aside Financial of India, banking institutions are permitted to help you impose their punishment charge whenever people too soon withdraw their shared money. But not, more banking companies fees ranging from 0.5percent and you will step onepercent of one’s interest, plus the investor must be generated familiar with so it prior to starting an enthusiastic FD membership.

Ideas on how to Remain secure and safe From Savings account Hackers

Due to their positioning inside highest-traffic section, pages don’t realize that all of the pages failed at the withdrawing fund. The fresh Act needs particular Automatic teller machine institution in order to meet standards to make certain he’s safer to use. To avoid which fraud, you should adopt aware practices when you play with an automatic teller machine.

Team Exceptional Checking – to 1200 incentive

MobileXpression are a no cost Ios and android app one to will pay your to suit your investigation. And it’s really a super easy-to-explore app that provides your totally free provide notes per month. The fresh secure Chime Visa Credit card are given by Bancorp Bank, N.A good. All of us out of advantages will bring clear, standard suggestions about budgeting, borrowing, protecting, paying, and more so you can create wise economic behavior. Centennial Bank now offers Options one hundred Examining inside the AL, AR, Fl, and you will Ny of these seeking reestablish its banking record.

- Another type of trickery involves the attachment from an untrue façade along side Atm host.

- However, it checking account is created specifically to help you cater to small and increasing companies that is equipped with of numerous incredible devices that make it invaluable.

- So it common couch potato money app will pay you fifty or maybe more a year to own discussing investigation about how your browse the net.

- Erin Bendig have extensive experience in various parts of individual money.

- Specific banking institutions offer shielded playing cards up against the FD as the a service, allowing you to utilize the credit card with your FD while the protection.

The new CorePlus Credit Partnership Effortless Family savings is the perfect options if you require a basic, no-frills bank account. Without lowest balance with no direct put expected, it’s very easy to get started. Examining accounts with no otherwise low fees and reduced lowest standards rated the best.

U.S. Lender offers as much as an excellent 1,200 acceptance incentive after you discover and you may money an alternative, eligible team family savings. The business membership your open should determine just how much added bonus currency you could potentially be eligible for. Quontic Financial’s Higher Interest Examining allows you to discover a merchant account with the absolute minimum deposit of one hundred. Then section, we offer no lowest equilibrium specifications and no monthly restoration payment.

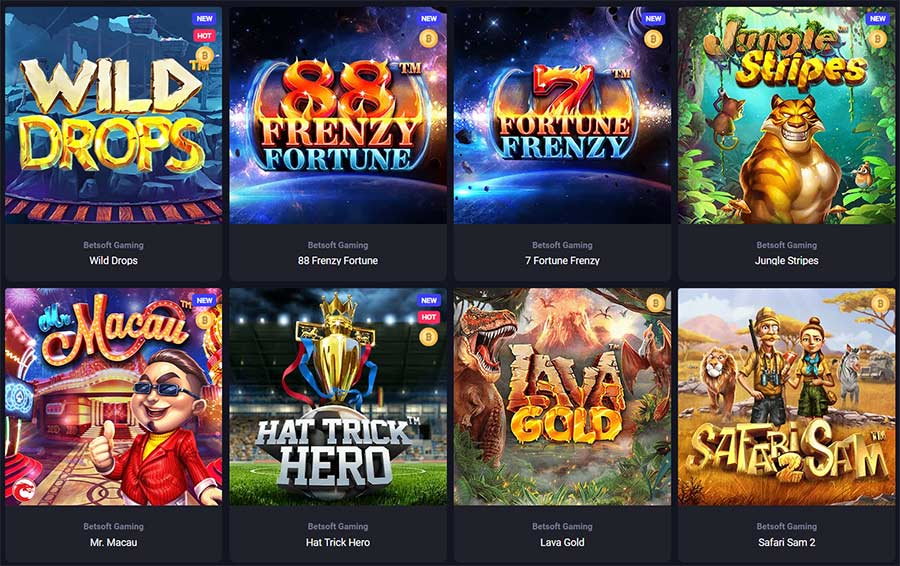

You must have a great Chime Savings account to start a great Chime Bank account. All the ports is actually HTML5 centered, therefore he could be backed by really browsers and cellphones. Such who want to enjoy on the move have no troubles since you may perform one another with a pill along with a cell phone.

I have not viewed a bonus out of Connexus inside some time therefore now would be a good time to help you access it that one. You’re qualified too, if you change your account and meet up with the the fresh money deposit requirements. I challenge one see some other team family savings providing that kind of APY. Very while you are, yes, the required deposit quantity are high, along with the fresh competitive interest, we feel that is an excellent chance of companies on the readily available dollars. However, for those who’re being unsure of regarding the cost or is actually dealing with a lengthy-name crisis — including employment losings otherwise medical emergencies — withdrawing the brand new FD may be a lot more fundamental.

For many who’lso are paying out-of-community charge usually, it can be really worth switching to an account that offers all over the country reimbursements or a more impressive no-payment system. Specific savers might imagine very early withdrawal if interest levels to own discounts profile begin rising across the board plus they need to dedicate within the another account with a higher give. If independence is essential or if you learn you can not lock out your bank account for a-flat time frame, traditional offers and you will examining profile was your best option. You’ll be able to merely give up the advantage of high demand for the fresh processes.